An ARDL approach for income inequality: Case studies for France, Greece, UK and USA

An ARDL approach for income inequality: Case studies for France, Greece, UK and USA

Abstract

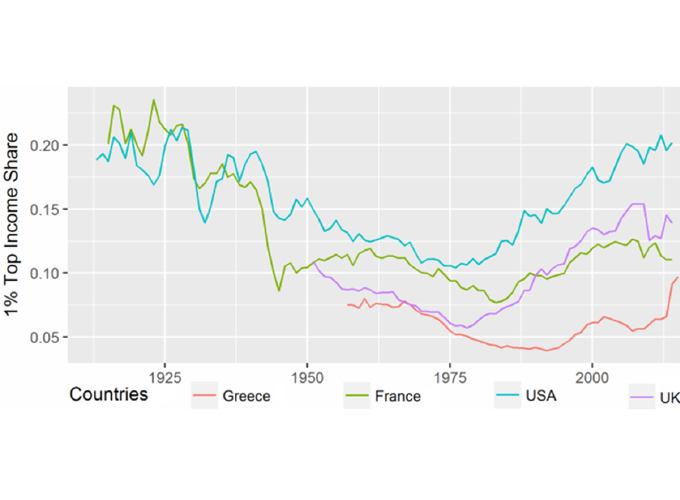

The purpose is to explore the cointegrating relationships between the 1% top income share and the macroeconomic factors of credit, education, GDP, inflation, population growth and trade in order to reveal if there is a long-run relationship. This relationship is tested for four different countries: Greece, France, USA and UK. We are trying to see if the income inequality is driven by the same factors and in the same way for such different economies. The popular ARDL bounds test for cointegration is used for this analysis. There are strong indications supporting the existence of such a relationship for the cases of France and Greece. For the case of USA, the test suggests the existence of a long-run relationship but a simple graphical inspection is enough to tell us that this is a false positive alarm (type I error) as this is a degenerate relationship. Finally, for the case of UK a not well-defined model supports the longrun relationship hypothesis but a more carefully designed model is against this decision.